Herausgegeben von Prof. Dr. Rita Schneider-Sliwa, Dep. Umweltwissenschaften, Abt. Humangeographie der Univ. Basel

Vol. 3 Nadezhda Sliwa

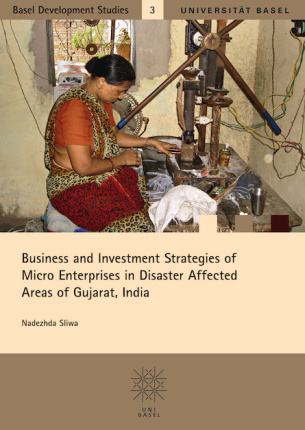

Business and Investment Strategies of Micro Enterprises in Disaster Affected Areas of Gujarat, India

The majority of India’s labor force is self-employed in the unorganized micro enterprise sector. Faced with financial constraints, lack of access to credit and professional advice, such enterprises are vulnerable and susceptible to external shocks and disasters. Knowing how micro enterprises cope after disasters, how they make strategic plans, take credit, invest and save, how they deal with suppliers and customers is important for understanding the potential of this sector and for improving micro development strategies. This study analyzes business and investment strategies of micro enterprises in disaster affected areas of Gujarat, India, using a case study and survey supported approach. Key questions are:

• How do micro enterprises manage their businesses?

• How do they handle credit, savings and investment?

• What are priorities of investment?

• How do micro enterprises overcome and adapt to disasters/external shocks?

• What factors define success or failure of micro enterprises?

• How does the organization in a Chamber of Commerce for micro enterprises affect the business?

Results show that investing in social expenses in order to build up social capital can go to the detriment of financial capital and thus, increases vulnerability. Savings are a main factor of business success as long as they are used for long-term productive investments and not for short-term social expenses which can use up all resources and possibly expose micro entrepreneurs to exploitative credit conditions. However, not formal education but financial literacy would seem to inform individual choices and priorities concerning investment of savings. These choices are what determines whether micro entrepreneurs are able to minimize their vulnerability to structural givens within their sphere of influence. In order to enhance financial literacy, savings and access to micro credit, the connection between social and financial capital should be further explored. Lessons learnt from informal businesses can lead to an adaptation of development strategies assisting micro entrepreneurs in the unorganized informal sector.

Bevorstehende Veranstaltungen

Bibliographische Angaben

| Reihe | Basel Development Studies |

|---|---|

| Seitenanzahl | 365 arabisch |

| Abbildungen | 221 s/w, 69 farbig |

| Tabellen | 199 |

| Zeichnungen | 32 |

| Format | 17 x 24 cm |

| Bindung | Buch, Broschiert |

| ISBN | 978-3-7965-2803-3 |

| Erscheinungsdatum | 01.03.2012 |